getty images

getty imagesThe Governor of the Bank of England has suggested that the Bank of England may cut interest rates more sharply if price rises remain under control.

Andrew Bailey told the guardian Depending on the inflation rate, the bank may be “a little more aggressive” in cutting borrowing costs.

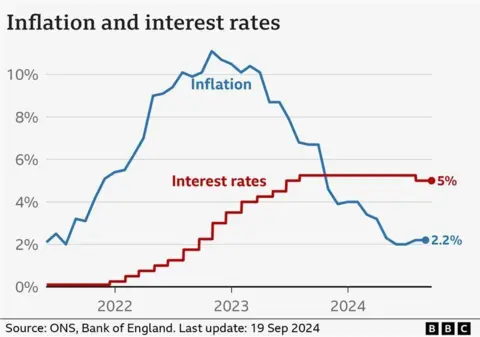

The bank cut interest rates to 5% from 5.25% in August, the first cut in more than four years.

Mr Bailey also said the bank was monitoring developments in the Middle East “extremely closely”, particularly any fluctuations in oil prices that could fuel inflation.

The Bank of England has two more meetings left in November and December this year to decide on interest rates.

At the bank’s last meeting in September, Mr Bailey was optimistic that borrowing costs would continue to fall. But he said at the time it was “crucial” that inflation remained low.

The bank raised interest rates steadily since late 2021 as inflation – the rate at which prices rise – increased, partly due to rising energy prices following Russia’s invasion of Ukraine.

However, now that inflation is close to the Bank’s 2% target, attention has turned to how far rates will be cut.

Falling interest rates will cut mortgage payments for households who have deals that track the Bank of England rate. However, most mortgage customers have fixed rate deals so they will not be immediately affected.

For savers, the rate cut is likely to reduce the amount of money they earn on their money.

Many analysts expect the bank to lower rates at its meeting in November. However, expectations for a rate cut in December also increased following Mr Bailey’s interview with the Guardian.

The pound fell almost 1% against the dollar to $1.317 on Thursday morning, on hopes lower rates mean people think they will make less money on their cash in UK property.

oil prices

One factor that could affect inflation is any impact on energy prices following an increase in conflict between Israel and the Iran-backed armed group Hezbollah in Lebanon.

“The geopolitical concerns are very serious. It’s tragic what’s happening,” Mr Bailey told the Guardian.

“There are clearly tensions and the real issue is how they might interact with markets still quite stretched in some places.”

The price of oil has reached above $76 per barrel this week due to fears of supply disruption.

However, the price of oil is still below levels seen earlier this year, and well below the peak of more than $130 a barrel seen after Russia’s invasion of Ukraine in 2022.

“My sense from all the conversations I have had with my counterparts in the sector is that at the moment, there is a strong commitment to keeping the market stable,” Mr Bailey said.

Mr Bailey was asked about claims by former Prime Minister Liz Truss, who alleged that her mini-budget in 2022 was not implemented because the Bank of England – among other members of the so-called “deep state” – had blocked her. Had weakened.

“I don’t know what he means by that,” Mr Bailey told the Guardian. He said he had never met Truss, who was Britain’s prime minister for 49 days.

Mortgage rates rose in the wake of the mini-budget following turmoil in the financial markets.

The Bank of England will announce its next interest rate decision on November 7.

Ways to make your mortgage more affordable

- Pay more. If you still have some time on a low fixed-rate deal, you may be able to pay more now to save later.

- Move toward an interest-only mortgage. This can keep your monthly payments affordable, even though you won’t be paying off the debt accrued when you buy your home.

- Extend the life of your mortgage. The typical mortgage term is 25 years, but 30 and even 40-year terms are now available.